Did you know that nearly 1 in 5 drivers in the United States are uninsured or underinsured?

This staggering statistic highlights the importance of having the right insurance coverage. Your auto insurance policy is designed to protect you from financial calamity in the event of a collision or related injury.

With so many options available, navigating the complex world of car insurance can be overwhelming. That’s why we’re here to guide you through the process, helping you find coverage that perfectly matches your needs and budget.

For personalized assistance, you can reach us via WhatsApp at +44-7822010953.

Key Takeaways

- Understand the different types of auto insurance coverage available.

- Learn how to navigate the insurance marketplace to find the best policy.

- Discover practical tips for comparing insurance companies and securing competitive rates.

- Find out how to balance comprehensive protection with affordable premiums.

- Get guidance on understanding policy language to make informed decisions.

Understanding the Basics of Auto Insurance

The world of auto insurance can be overwhelming, but knowing the basics can simplify your choices. Auto insurance policies are composed of various coverage types, some of which are mandatory, while others are optional.

Mandatory vs. Optional Coverage Types

Mandatory coverage types are those required by law, typically including liability insurance, which covers damages to others in an accident. Optional coverage types, such as comprehensive and collision coverage, provide additional financial protection against various risks.

State Minimum Requirements in the US

Each state sets its own minimum liability limits, expressed as a series of numbers (e.g., 25/50/25), representing bodily injury and property damage coverage. Insurance companies offer varying limits, and choosing the lowest amount required may not provide sufficient financial protection.

| State | Minimum Liability Limits | Property Damage Limit |

|---|---|---|

| California | 15/30 | $5,000 |

| New York | 25/50 | $10,000 |

| Texas | 30/60 | $25,000 |

Understanding these basics is the first step in building an adequate insurance policy that protects your assets.

Assessing Your Personal Insurance Needs

Your personal circumstances play a significant role in determining the right insurance for you. To make informed decisions, it’s essential to evaluate various factors that influence your insurance requirements.

Evaluating Your Vehicle’s Value and Age

The value and age of your vehicle significantly impact your insurance needs. For older vehicles, comprehensive and collision coverage might not be cost-effective. We help you assess whether the cost of coverage is justified by your vehicle’s value.

Considering Your Driving Habits and History

Your driving habits and history are crucial in determining your insurance premiums. A clean driving record can lead to lower costs, while a history of accidents may increase your premiums. We consider these factors to help you save money on your insurance.

Analyzing Your Financial Situation

Your financial situation directly affects your ability to absorb potential out-of-pocket costs after an accident. When deciding on your car insurance deductible, consider how much you can afford to pay. A higher deductible can lower your premiums but may increase your costs in the event of a claim.

| Financial Factor | Impact on Insurance |

|---|---|

| Emergency Savings | Affects ability to pay deductible |

| Assets to Protect | Influences liability coverage needs |

| Budget Constraints | Determines affordable premium costs |

By analyzing these factors, we can help you strike a balance between monthly premium costs and your ability to pay out-of-pocket expenses, ultimately helping you save money and make informed insurance decisions.

How to Choose the Best Auto Insurance Policy

When it comes to auto insurance, making an informed decision is crucial for protecting yourself and your assets. To choose the best auto insurance policy, you need to carefully consider several factors, including your financial situation, driving habits, and the value of your vehicle.

Liability Coverage: Finding the Right Limits

Liability coverage is a critical component of your auto insurance policy, as it helps protect you from financial losses in case you’re at fault in an accident. The key is to determine the appropriate liability limits that balance your financial exposure with premium costs.

Comprehensive and Collision Coverage Decisions

Comprehensive and collision coverage are optional but valuable protections for your vehicle. Comprehensive coverage handles damages not related to accidents, such as theft or natural disasters, while collision coverage pays for damages resulting from a crash. You should assess your vehicle’s value and your financial situation to decide if these coverages are right for you.

Personal Injury Protection and Medical Payments

Personal Injury Protection (PIP) and Medical Payments coverage are designed to cover medical expenses for you and your passengers after an accident. PIP insurance, in particular, can provide additional benefits beyond medical expenses, such as lost wages and essential services. If you live in a state that requires PIP, you must carry the minimum required amount, but you may want to consider increasing it, especially if you don’t have health insurance.

- Personal Injury Protection (PIP) and Medical Payments coverage address medical expenses for you and your passengers.

- These coverages can work alongside your health insurance to provide comprehensive protection.

- Some states require PIP coverage, while in others it’s optional—understanding your state’s requirements is essential.

- PIP can cover lost wages and essential services beyond what health insurance typically covers.

Factors That Affect Your Insurance Premiums

The cost of your auto insurance is influenced by a range of factors, including personal and external elements. Understanding these factors can help you make informed decisions when selecting an insurance policy.

Driver Profile and History Considerations

Your driving history and profile play a significant role in determining your insurance premiums. A clean driving record with no accidents or tickets can lead to lower rates. Insurance companies view drivers with a history of safe driving as less risky.

Vehicle Type and Its Impact on Rates

The type of vehicle you drive also affects your insurance rates. Luxury or high-performance vehicles are typically more expensive to insure than standard models. We recommend checking insurance costs before purchasing a vehicle.

Geographic Location and External Conditions

Where you live and park your vehicle significantly impacts your insurance premiums. For instance, areas prone to natural disasters or with high crime rates may have higher premiums due to the increased risk. You can visit https://www.valuepenguin.com/auto-insurance to learn more about how your location affects your insurance costs in your state.

Some external risk factors may be mitigated through security measures or garage parking, potentially qualifying you for discounts with your insurance company.

Exploring Optional Coverage Add-ons

Beyond the basics, there are several optional coverage add-ons that can significantly enhance your auto insurance policy. These add-ons provide extra layers of protection and can be tailored to your specific needs.

Roadside Assistance and Rental Reimbursement

Roadside assistance can be a lifesaver during an accident or breakdown, offering services like towing and fuel delivery. Rental reimbursement coverage helps cover the cost of a rental car while your vehicle is being repaired after a covered claim.

Gap Insurance and New Car Replacement

Gap insurance covers the difference between your car’s actual cash value and the amount you owe on your loan or lease if your car is totaled. New car replacement coverage allows you to replace your new vehicle with a similar model if it’s totaled within a certain period.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist coverage protects you when you’re in an accident with a driver who has insufficient or no insurance. This protection is increasingly important as many drivers carry only minimum liability limits or drive without insurance entirely.

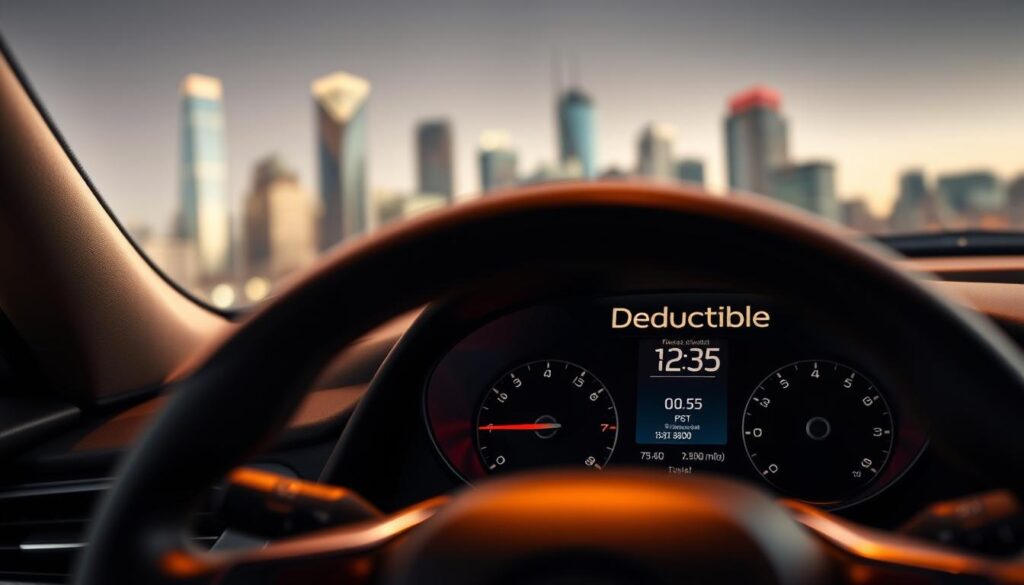

Selecting the Right Deductible Amount

One of the most important decisions you’ll make when buying auto insurance is your deductible amount. The deductible is the amount you pay out of pocket when you make a claim. Insurance company deductibles vary, but generally range between $50 to $1,000.

Understanding how deductibles impact your auto insurance is crucial. The lower your deductible, the more expensive your premiums may be, while a higher deductible can help to lower your premiums. However, a higher deductible means you’ll pay more money when you make a claim.

Balancing Premium Costs vs. Out-of-Pocket Expenses

When choosing a deductible, you need to balance the premium costs against potential out-of-pocket expenses. A higher deductible can save you money on premiums, but you’ll need to ensure you have adequate funds to cover the deductible in case of a claim.

When to Choose Higher or Lower Deductibles

Higher deductibles make sense when you have adequate emergency savings and want to minimize premium costs. On the other hand, lower deductibles are appropriate when you have limited savings or want more predictable expenses after an accident.

| Deductible Amount | Premium Cost | Out-of-Pocket Expense |

|---|---|---|

| Low ($50-$200) | Higher | Lower |

| Medium ($500) | Moderate | Moderate |

| High ($1,000) | Lower | Higher |

As shown in the table, there’s a trade-off between premium costs and out-of-pocket expenses when choosing a deductible. It’s essential to evaluate your financial situation and risk tolerance to make an informed decision.

Comparing Insurance Companies Effectively

To secure the best coverage, it’s essential to compare insurance companies based on several key factors. This comparison will help you identify which insurer offers the best combination of price, service, and coverage for your specific needs.

Researching Financial Stability and Ratings

One crucial aspect is the financial stability of the insurance company. You can research this by looking at ratings from reputable agencies such as A.M. Best, Moody’s, or Standard & Poor’s. These ratings provide insight into an insurer’s ability to pay claims. Companies with higher ratings are generally more stable and reliable.

Evaluating Customer Service and Claims Process

Another important factor is the quality of customer service and the efficiency of the claims process. You can evaluate this by reading reviews, asking for referrals, and checking ratings from the Better Business Bureau or similar organizations. Effective customer service can make a significant difference when you need to file a claim.

Utilizing Online Comparison Tools

Online comparison tools can streamline the process of gathering and comparing quotes from multiple insurers. By using these tools, you can quickly see how different companies offer varying premiums for the same coverage. However, it’s also important to directly communicate with insurers to clarify details and verify discounts.

Through a survey of more than 40,000 insurance policyholders, it has been identified that the insurance companies which offer the best service with the most competitive monthly premiums are those that balance financial stability with good customer service. By comparing quotes and services, you can find the best car insurance for your needs.

Conclusion: Securing the Best Coverage for Your Needs

As we’ve explored throughout this article, selecting the right auto insurance coverage involves several key considerations. To find the perfect policy, you must understand your needs, research available options, and make informed comparisons. We’ve guided you through evaluating coverage types, determining appropriate limits, selecting deductibles, and comparing insurance providers.

Remember, the best car insurance policy for you balances adequate protection with affordable premiums while addressing your specific risk factors. Regularly reviewing your coverage as your circumstances change ensures your auto insurance continues to meet your needs over time. For personalized assistance, contact us via WhatsApp at +44-7822010953.

The time invested in finding the right auto insurance policy pays dividends in financial protection and peace of mind. As your life stages and vehicle ownership situations change, you may need to adjust your policies to maintain optimal coverage.